In the high-stakes world of asset gathering, time is a scarce commodity and sales talent doesn’t come cheap. Fund executives know that keeping salespeople productive means minimizing time spent on manual research and maximizing time in front of qualified prospects.

That’s where institutional and intermediary investor databases come into play. These platforms promise targeted access to allocators, but the quality, accuracy, and pricing models vary widely. Choosing the right one can shape the efficiency—and ultimately, the success—of your distribution strategy.

At Octum, we’ve approached this challenge differently. Simply, we combine superior investor data, a proprietary AI-driven targeting framework, and a tiered usage model that avoids the ballooning costs associated with seat-based licenses. It’s designed for firms that want scalability without the pricing surprises.

Before you invest in any database, ask yourself two questions?

- Do I need another flat list of organizations and old names and generic titles, or do I need a system that helps me prioritize who’s actually likely to invest?

- Am I paying for bloated licenses and extra seats (their incentive), or am I only paying for actual usage and results (our incentive)?

Traditional investor databases are expensive, inflexible, and static—selling you outdated profiles and charging per seat regardless of how often they’re used. That model may have worked 10 years ago, but fundraising has changed. These database companies are incentivized to sell you as many seats to maximize revenue, they care if you renew (auto-renew – that is). You can tell this by the questions they ask (who is going to be using it, from where?)

Prices listed are estimates, as they fluctuate and are often negotiable. Descriptions are sourced directly from each provider’s website.

eVestment, a platform under Nasdaq, delivers comprehensive investment analytics, data, and insights regarding both public and private markets. The believe they are the “source for institutional intelligence.” They add, “Nasdaq eVestment™ brings transparency and efficiency to the global institutional market, equipping managers, asset owners and consultants to make data-driven decisions, deploy their resources more productively and ultimately realize better outcomes.”

- Estimated Costs including seats: $15,000 – $80,000

- Investor Focus: Institutional Investors

- Core Focus: Tracking Manager Performance Data and Fund Demand

- Owner: Nasdaq

MMD has been around for decades and was originally a book directory. The legacy product is orphaned by its more popular financial data product: CapitalIQ. MMD is a database that, “Pinpoint prospects, identify new sales opportunities, and build lasting relationships using market leading data. MMD is your essential partner in finding institutional investors.”

- Estimated Cost Per Seat: $5,000 – $15,000

- Investor Focus: Institutional Investors

- Core Focus: Investor Allocation Data and Contact Information

- Owner: S&P

Preqin’s initial focus was on private equity. They later evolved to cover other types of alternative investments. Preqin claims to be “The Home of Alternatives”. They are “Empowering the global alternatives community with essential data and insight.” The company sold to BlackRock.

- Estimated cost: (Extracted in August 2025) Based on Vendr’s internal transaction data for Preqin, the minimum price is around $25,000 and the maximum price is approximately $81,000. The average cost for software is about $51,500 annually. Source: https://www.vendr.com/buyer-guides/preqin

- Focus: Alternative Investments

- Owner: BlackRock

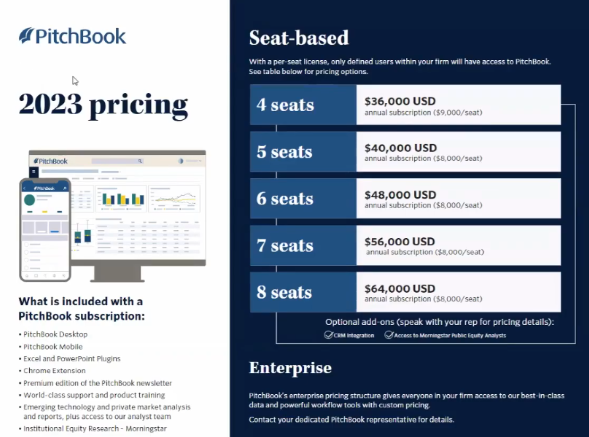

Pitchbook was founded by John Gabbert in 2007 to focus on venture capital and private equity funds. The company later sold to Morningstar. According to PitchBook, they are the premier resource for comprehensive data on the global capital markets and proprietary research and insights. Their database is designed to empower your best work, and help capital market professionals win what’s next.

- Estimated Cost: $36,000 for 4 seats.

- Core Focus: Private Equity, Venture Capital, Private Company Data, M&A

- Owner: Morningstar

Screenshot Source: Pitchbook Demo Call. (2023) https://www.youtube.com/watch?v=cTW0-xcXf1Y

Honorable mentions: Dakota Marketplace (U.S. focus, RIA, Institutional, CRM database product), FINTRX (core focus in family office), and Mandatewire (strong in Europe institutional).

IF YOU,

If you need lists of private equity firms, alternative investment returns data, and benchmark data, Preqin serves managers in that space.

If you’re a private equity fund manager looking for data on allocators, venture capital funds, and privately held companies, PitchBook may be a fit.

For broader institutional datasets, Money Market Directory and Nasdaq eVestment are traditional options. These options are better if you are more of a equity/bond fund manager with over $50 billion in AUM.

But if you’re serious about raising capital now and don’t have time to dig through outdated profiles or generic lists; Octum is built for you.

Octum isn’t a flat database. It’s a decision engine that is driven by real-time data, AI, and a proprietary targeting framework. It is built to surface the right investors for your strategy and structure. We’re market-agnostic, and we get you in front of people who actually allocate. By the way, capital matching is not the only thing Octum does, as we have a slew of workflows designed for finance professionals.

Ready to accelerate your fundraising? Book a demo with Octum and put your sales team in motion.